Atlanta, July 14, 2025 (GLOBE NEWSWIRE) — When unexpected expenses hit, it can feel overwhelming, especially if you have bad credit. You might think there are no good options, but that’s not always the case. This guide explores personal loans designed for people with less-than-perfect credit, even offering potential access to up to $5,000.

Honest Loans – Your Flexible Option for Personal Loans with Bad Credit

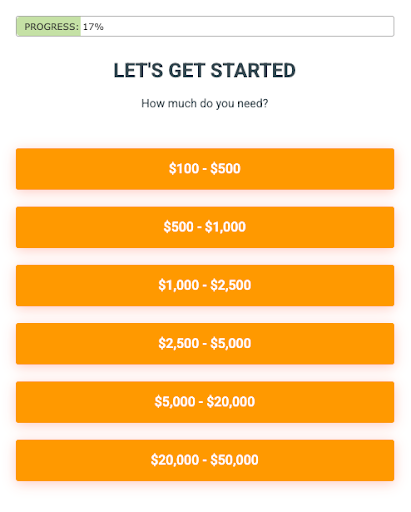

Looking for a lender that can meet your immediate cash needs? Honest Loans stands out as a flexible personal loan provider. They can connect you with lenders offering up to $5,000, even if you have a less-than-perfect credit history.

Why consider Honest Loans?

- Secure and Easy Online Process: Apply from the comfort of your home, without needing to visit an office.

- Fast Decisions & Funding: Typically, applications are approved within 1-2 hours, and funds can be disbursed quickly once approved.

- User-Friendly Interface: Their platform makes applying for a bad credit personal loan straightforward.

What Exactly is a Payday Loan for Bad Credit?

A payday loan is a short-term loan designed to give you quick access to cash for urgent needs. These loans usually range from a few hundred to a few thousand dollars. As the name suggests, the idea is to repay the loan on your next payday.

Payday loans are particularly helpful for individuals who need instant cash but might not qualify for traditional bank loans due to poor credit, limited income, or unemployment. The application process is generally simple, often requiring proof of income and a bank account.

Understanding “Guaranteed Approval” and How These Loans Work

While “guaranteed approval” is a strong term, it generally means that lenders offering these types of loans are more focused on your current ability to repay rather than solely on your credit history. Many of these lenders perform “soft” credit checks, which don’t negatively impact your credit score.

These loans are often a lifeline when you need to bridge the gap between your current funds and urgent costs. They’re designed to be accessible whether you’re employed, unemployed, or have a history of bad credit or no credit at all.

How Payday Loans Work

The process for getting a payday loan is usually much simpler and faster than traditional loans. Everything, from applying to getting your funds, can often be done online. Automated systems quickly check your eligibility and approval conditions. This means you can typically get a decision and funding without waiting in line.

Once approved, you’ll receive a loan agreement detailing the terms. You then decide whether to accept the offer.

Who Qualifies for a Payday Loan for Bad Credit?

Payday loans have relatively straightforward qualifications, which is why they have a high approval rate for many borrowers:

- You must be a US Citizen or permanent resident.

- You need to be at least 18 years old.

- You must have a verifiable source of income.

- You need a bank account.

- You must have a phone number or email address for communication.

Credit Scores and Payday Loans

For many payday loans, your traditional credit score often has little direct impact on your approval. Lenders typically perform a “soft” credit check, which reviews your credit history but doesn’t affect your score. This makes these loans more accessible if you have poor credit.

It’s worth noting that while your credit score might not be a barrier, responsible repayment can actually help your credit. Making timely payments on a payday loan can positively influence your credit rating, and if you have no credit history, it can be a good starting point.

Payday vs. Conventional Loans: Key Differences

Here’s a quick comparison to highlight how payday loans differ from traditional bank loans:

- Loan Amount: Payday loans are typically for smaller amounts ($100s to a few $1000s), while conventional loans can be much larger ($1,000s to $100,000s).

- Repayment Terms: Payday loans are short-term, usually due on your next payday. Conventional loans offer longer repayment periods (months to years).

- Interest Rates: Payday loans have significantly higher interest rates and fees due to their short-term nature and higher risk. Conventional loans generally have lower rates.

- Credit Checks: Payday lenders often use soft credit checks or no credit checks. Conventional lenders require thorough credit checks and sometimes collateral.

- Approval Time: Payday loans are typically approved and funded within hours. Conventional loans can take days or weeks.

- Borrower Eligibility: Payday loans target those with poor or no credit. Conventional loans are usually for individuals with good credit scores and steady income.

- Use of Funds: Payday loans are often for emergency expenses. Conventional loans are used for larger purchases like cars or homes.

Regulating Payday Loans for Bad Credit

Payday loans are a topic of significant discussion, and as a result, regulations vary widely by state. Some states limit the loan amounts, while others have banned payday loans entirely. It’s crucial to check your state’s specific eligibility and regulations before applying.

The Pros and Cons of Payday Loans for Bad Credit

Like any financial product, payday loans have their advantages and disadvantages:

Upsides:

- Fast Approval: Many lenders offer same-day or next-day funding, which is crucial for urgent cash needs.

- No Hard Credit Check: Often, your credit score isn’t a primary factor, making them accessible to those with bad or no credit.

- Flexible Eligibility: Requirements are often basic (proof of income, ID, bank account), increasing your chances of qualification.

- Smaller Loan Amounts: Ideal if you only need a small sum to cover an unexpected bill.

- Convenience: Many applications are fully online, saving you a trip to a physical location.

Downsides:

- Risk of Debt Cycle: High interest rates and short repayment periods can lead to a cycle where you borrow again to pay off the first loan.

- High-Interest Rates: Annual Percentage Rates (APRs) can be extremely high, sometimes 300-400% or more.

Frequently Asked Questions (FAQs)

What happens if I default on a payday loan?

If you can’t repay on time, you might face additional fees or a negative impact on your credit score, making it harder to get loans in the future. Some lenders may offer alternative repayment methods.

Can I get a payday loan if I have bad credit?

Yes, many payday lenders don’t rely on traditional credit checks, so bad credit often isn’t a barrier to approval.

How quickly can I get a payday loan?

Often, you can get a decision within minutes or hours, and funds can be deposited into your bank account on the same day or the next business day.

- Contact Honest Loans: Phone: 888-718-9134

- Email: [email protected]

Disclaimer & Affiliate Disclosure:

This article is for informational and commercial purposes only and does not constitute financial or legal advice. While we strive for accuracy, we do not guarantee completeness or timeliness. Always verify information and consult with a licensed financial advisor before making any financial decisions.

Loan terms, eligibility, and interest rates vary by lender and state. Loan approval is never truly “guaranteed” and depends on the lender’s verification of various factors, including your location, identification, income, and regulatory compliance.

This content may include affiliate links. If you click and apply for a product, we may receive a commission at no extra cost to you. This does not affect our editorial integrity. Opinions expressed are general and don’t reflect specific lending institutions unless stated.

By reading this, you agree that the publisher and its partners are not liable for any inaccuracies, omissions, or damages resulting from the use of this material, including financial losses or application denials.

Company names like “Honest Loans” are for informational comparison and don’t imply a legal partnership or endorsement. Direct any service inquiries to the specific company.

All trademarks, service marks, and company names belong to their respective owners.

Wall St Business News, Latest and Up-to-date Business Stories from Newsmakers of Tomorrow