Canada, Toronto, Nov. 11, 2024 (GLOBE NEWSWIRE) — The Global Oilfield Services market is rising due to factors such as the growing oil and gas production and exploration activities, Industrial technological advancements, and rising demand for improved oil recovery techniques. This expansion is further highlighted by a partnership between Halliburton and Oil States Industries to provide advanced & innovative solutions for safe and efficient deepwater drilling projects.

Introspective Market Research is excited to unveil its latest report, “Oilfield Services Market “ This in-depth analysis shows that the global Oilfield Services market, valued at USD 147.07 billion in 2023, is poised for substantial growth, expected to hit USD 232.09 billion by 2032. This growth trajectory aligns with a strong CAGR of 5.2% during the forecast period from 2024 to 2032.

The oilfield services market is crucial to the well-organized operation of oil and gas fields globally, offering specialized services from hydrocarbon exploration to drilling, well completion, intervention, and production enhancement. These services are essential to maximizing production and safeguarding operational efficiency in oil and gas extraction procedures. As energy demand increases worldwide, particularly in emerging markets, the market for oilfield services is growing, motivated by increased exploration and production activities. The recent growth in shale gas development and demand for enhanced oil recovery methods further boost this market, with offshore regions experiencing heightened demand for these services.

One of the key factors driving market expansion is the rapid pace of technological advancement in oilfield services, which has improved production yield, reduced operational costs, and enabled better resource management. Oilfield services have adapted to support traditional drilling, unorthodox shale operations, offshore deep-water drilling, and enhanced oil recovery techniques, making them versatile in handling complex geological conditions and well structures. Companies are also providing customized service packages, which help operators manage costs effectively while increasing productivity, making the services highly sought-after by upstream companies.

The sector’s growth is also maintained by the growing demand for energy, fueled by factors like global urbanization, industrialization, and consumption of high energy in transportation and generation of power. Oilfield services have leveraged the latest techniques such as hydraulic fracturing, directional drilling, and reservoir stimulation giving access to previously inaccessible reserves. Digital transformation in the form of data analytics, automation, and other advanced technologies has further enhanced operational safety, precision, and overall production efficiency, solidifying oilfield services’ role in meeting the global energy demand.

Despite these growth drivers, the market faces certain challenges, including fluctuating oil prices influenced by global supply-demand dynamics and geopolitics, which can impact demand for oilfield services. Additionally, concerns over environmental impact, emissions, and worker safety are swelling, creating both regulatory and reputational challenges for the industry. As oilfield service companies continue to innovate with cost-effective and eco-friendly solutions, they remain well-positioned to play a crucial role in fulfilling the world’s energy needs in the foreseeable future.

Download Sample 250 Pages Of Oilfield Services Market Report@ https://introspectivemarketresearch.com/request/17082

Rise in Shale Gas Extraction

The rising need for extracting shale gas is a key aspect of the oilfield services industry. Unconventional reservoirs of shale gas reserves require advanced techniques such as directional drilling and hydraulic fracturing for extraction purposes which increased the necessity for expert drilling services. This opens up chances for oilfield service companies skilled in these techniques.

Advanced completion methods, like hydraulic fracturing, are required to optimize the extraction of shale gas. The rising demand for these services has formed Various opportunities. Opportunities for New business companies specializing in shale-related activities, leading to a greater significance of oilfield service providers in the energy industry.

Hydraulic fracturing needs large amounts of water, which makes special difficult to obtain, move, and get rid of it. This has led to the emergence of a specific market in the oilfield services sector for companies that focus on water management and treatment solutions to assist operators in addressing environmental and logistical issues related to water usage.

The increase in shale gas extraction leads to a need for more infrastructure such as pipelines, storage, and processing facilities. It is crucial to have oilfield service providers with expertise in engineering, procurement, construction, and project management to assist in the expansion of this infrastructure. Services such as data analytics, automation, and predictive maintenance provide new solutions that help operators improve efficiency and sustain operations.

Boosting Production & Investigative Operations in the Oil & Gas Industry to Support Market

The oilfield services market is experiencing robust growth. This growth is driven by growing activities like production and exploration in the oil and gas industry, predominantly in offshore regions. The upstream sector places high value on these services, especially given their critical role in capitalizing on output from offshore assets. As requirement & demand for oil and gas escalate worldwide, offshore regions are highly important, powering demand for specialized oilfield services.

A noteworthy contributor to market expansion is the rapid increase in shale gas extraction, propelled by advanced techniques such as stimulation methods and hydraulic fracturing. Shale gas is a crucial energy source. The constant advancement in technology in extraction processes is enabling great profits. These techniques are essential in unlocking new reserves and in optimizing recovery from existing ones, making oilfield services indispensable in the modern energy landscape.

Declining costs in oilfield services have incentivized operators to ramp up production efforts. Reduced costs not only make exploration more viable but also allow producers to scale operations with greater efficiency, positively impacting the market for oilfield services. This price reduction has become an essential factor in maintaining consistent production levels amidst volatile oil prices.

Increased global energy demands are accelerating the expansion of the oilfield services market. The sector’s continued growth reflects the industry’s response to meet energy needs through efficient extraction and production, particularly in offshore regions where untapped reserves offer promising potential.

“Research made simple and affordable – Trusted Research Tailored just for you – IMR Knowledge Cluster”

https://www.imrknowledgecluster.com/

What Opportunities Are Emerging in the Oilfield Services Market Due to New Discoveries??

The oilfield services market is undergoing noteworthy growth due to increasing oilfield discoveries around the globe. This creates a necessity for activities like extensive exploration for the evaluation of potential reserves and commercial viability. Oilfield service companies concentrate on seismic data acquisition, interpretation, and analysis which are crucial in identifying promising exploration areas. As new discoveries arise, the need and demand for these services escalate which presents extensive opportunities for service providers in the segment.

Following the identification of new oilfields, drilling and well services become crucial for reservoir evaluation and extraction of hydrocarbon. Companies tangled in engineering, procurement, construction, and project management services find lucrative prospects as they support the research and development of vital infrastructure. This flow in drilling and well services creates a promising environment for companies in oilfield services. This enhances their growth potential.

Understanding the characteristics of newly discovered reservoirs is essential for optimizing production and maximizing recovery. Service providers specializing in reservoir evaluation, well testing, and formation evaluation techniques play a pivotal role in accurately assessing reservoir properties. With the increasing number of discoveries, the demand for these specialized services rises, offering further opportunities for oilfield service companies.

The development of new oilfields often requires advanced production techniques to enhance output. Companies that provide production optimization services, like well stimulation and artificial lift systems. This witnessed increased demand as operators sought to maximize production from newly discovered fields. This evolving landscape creates ample opportunities for oilfield service providers to leverage their expertise and contribute to the industry’s growth.

Do you need any industry insights on Oilfield Services Market, Make an enquiry now >> https://introspectivemarketresearch.com/inquiry/17082

What are the Challenges Faced in the Oilfield Services Market?

The oilfield services market is facing significant challenges due to strict governmental rules & oversight of activities like exploration and production. In response to increasing environmental concerns, countries around the globe have adopted a series of new regulations that have significantly increased the regulatory burden on the oil and gas industry. This change towards more rigorous governance is mainly aimed at endorsing sustainability and reducing greenhouse gas emissions.

One of the crucial areas impacted by these regulations is the requirement for all-inclusive reporting of greenhouse gas emissions. Companies are now instructed to monitor and disclose their emissions with more transparency. This will increase operational costs and necessitate the implementation of systems like tracking and reporting. This regulatory demand can strain resources, particularly for smaller operators who may lack the infrastructure to comply effectively.

The introduction of performance standards for oil and gas operations has raised the bar for operational efficiency and safety. Firms must now adhere to strict guidelines that govern their operational practices, pushing them to invest in advanced technologies and training to meet compliance requirements. This added complexity can hinder operational agility and innovation as companies prioritize regulatory compliance over exploratory and production initiatives.

Regulations concerning the maintenance of stationary gas and diesel engines have placed additional pressure on operators. Ensuring compliance with maintenance guidelines involves ongoing investment and necessitates a skilled workforce capable of adhering to the new standards. Collectively, these challenges highlight the need for oilfield services companies to adapt to an evolving regulatory landscape, which may ultimately affect their competitiveness and profitability in the market.

Key Manufacturers

Market key players and organizations within a specific industry or market that significantly influence its dynamics. Identifying these key players is essential for understanding competitive positioning, market trends, and strategic opportunities.

- Schlumberger Limited (USA)

- Halliburton Company (USA)

- Baker Hughes Company (USA)

- Weatherford International plc (USA)

- National Oilwell Varco, Inc. (NOV) (USA)

- TechnipFMC plc (UK)

- Transocean Ltd. (Switzerland)

- Saipem S.p.A. (Italy)

- China Oilfield Services Limited (COSL) (China)

- Petrofac Limited (Jersey)

- Oceaneering International, Inc. (USA)

- Wood Group (John Wood Group plc) (UK)

- Superior Energy Services, Inc. (USA)

- Expro Group (UK)

- Valaris plc (USA)

- Ensco Rowan plc (UK)

- Helmerich & Payne, Inc. (USA)

- Nabors Industries Ltd. (Bermuda)

- Weatherford International plc (USA)

- Patterson-UTI Energy, Inc. (USA)

- Liberty Oilfield Services Inc. (USA)

- Basic Energy Services, Inc. (USA)

- Key Energy Services, Inc. (USA)

- Trican Well Service Ltd. (Canada)

- Calfrac Well Services Ltd. (Canada)

- NexTier Oilfield Solutions Inc. (USA)

- Archer Limited (Bermuda), Other Active Players

In April 2024, Deep Well Services (DWS) and CNX Resources Corp. partnered to establish AutoSepSM Technologies, a new oilfield service company focused on enhancing conventional flowback operations. This joint venture will leverage CNX’s technological expertise and DWS’s high service quality standards. Operating as an independent entity, AutoSep will be managed by DWS, allowing it the flexibility and autonomy to deliver automated flowback solutions tailored for the oil and gas industry. This collaboration aims to significantly improve operational efficiency and effectiveness in flowback processes, positioning AutoSep as a leader in innovative oilfield services.

In Mar 2024, Azad Engineering announced that it signed a strategic supply agreement with Baker Hughes Oilfield Operations LLC, USA, to provide medium-high complex precision machined components for oil field services. This contract was expected to generate substantial business value over the next five years and was extendable for three additional one-year terms. As a key manufacturer of qualified product lines, Azad Engineering supplied global original equipment manufacturers (OEMs) in the energy, aerospace, defense, and oil and gas industries. The company specializes in highly engineered, complex, mission-critical, and life-critical high-precision forged and machined components.

Key Segments of Market Report

By Service:

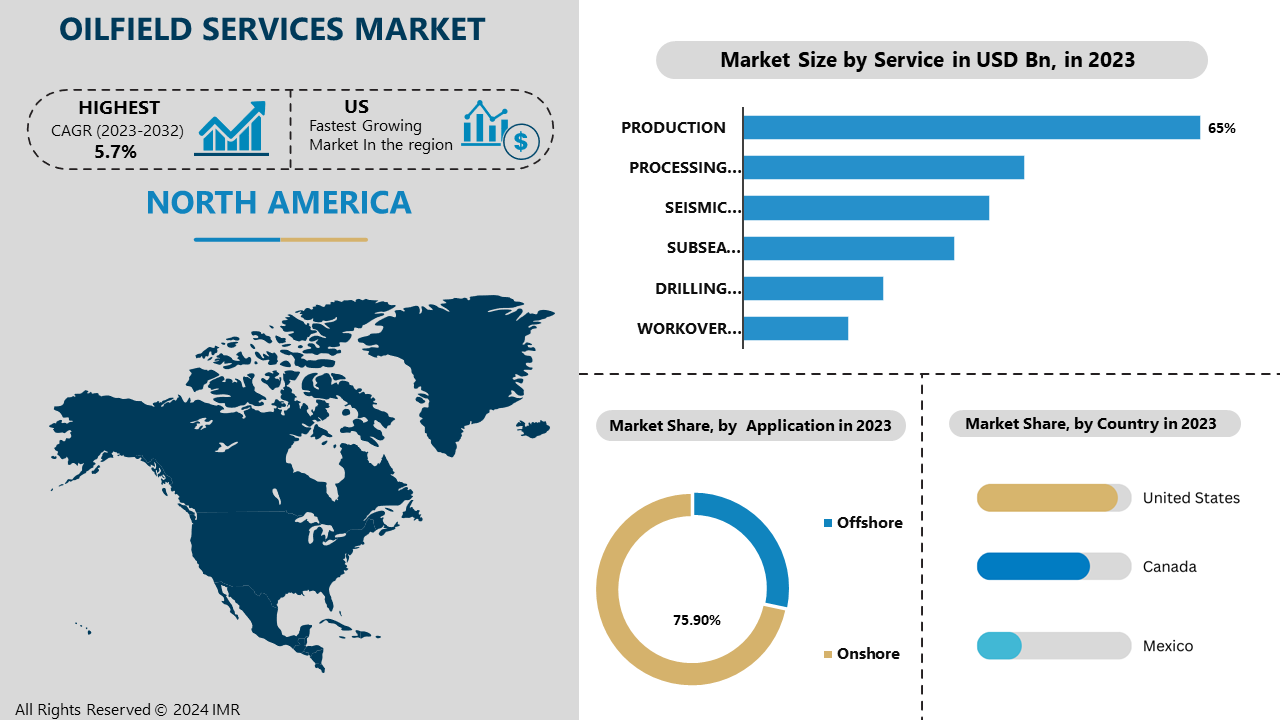

The oil and gas fields are currently seeing a growing emphasis on oil recovery and well-testing within the production sector. This section offers various oilfield services including artificial lift systems, floating production vessels, support vessels, well testing services, subsea equipment, Christmas trees, enhanced oil recovery, digital oilfield, and other production services. Due to an increase in offshore drilling for oil and gas exploration, extraction, storage, and processing, the drilling sector is expected to secure the second-highest market share.

Service providers can generate consistent revenue through these services. Production services play a crucial role in maximizing the productivity of oil and gas wells. Their main priorities are increasing production rates, enhancing reservoir management, and utilizing technologies to optimize recovery rates. Operators depend significantly on production services to sustain efficient and lucrative operations.

Production services frequently require extended agreements between service providers and oil and gas companies. These agreements guarantee that services will be available during the entire duration of oilfield activities, establishing consistent income for service providers. The production sector includes different services that cater to the various requirements of oil and gas production. This involves testing wells, enhancing methods, using artificial lift systems, and optimizing production strategies. The variety of services provided boosts the power of the manufacturing sector.

By Application:

The onshore segment held the largest share in 2023. Onshore oilfield operations have the benefit of being effortlessly accessible in contrast to offshore or remote areas. Maximum time, onshore fields are found on land and come with infrastructure like pipelines, roads, and storage facilities. The convenience streamlines operations, cuts expenses, and improves oilfield efficiency. Onshore operations are typically more economical than offshore operations. Closeness to infrastructure and services lowers transportation, offshore maintenance, and complex installation costs.

This cost advantage is what attracts companies to onshore operations and contributes to the onshore segment’s dominance. Numerous areas across the globe contain significant onshore oil and gas deposits. Oil and gas operators are often drawn to onshore development due to the significant production potential found in these reserves. The strong production levels from these onshore fields further solidify the control of the onshore sector.

Operations on land usually have less strict regulations and permitting needs than operations at sea. This streamlined regulatory process and simplified complexity lead to faster project approvals, facilitating quicker development and production activities. This regulatory benefit further enhances the onshore segment’s dominance. The onshore sector is taking benefit of improvements in technology. This results in improved efficiency and cost savings. Horizontal drilling, hydraulic fracturing, and improved oil recovery methods have transformed land-based operations, opening up previously unreachable reserves and boosting production rates.

By Region:

It is anticipated that North America will lead the market throughout the forecast period. North America, precisely the Canada and US, possesses plentiful oil and natural gas reserves. Noteworthy production potential has been unlocked in the U.S. due to massive shale oil deposits and technology advancements such as hydraulic fracturing (fracking). Canada has significant oil sands, which also adds to the area’s abundance of resources. The US is at the forefront of worldwide innovation and oilfield technology. Technological Advancements in methods such as fracking and horizontal drilling have transformed the sector by turning once unobtainable reserves into highly money-making resources.

The area is advantaged by strong investment in oil and gas infrastructure. This involves huge networks of pipelines, refineries, and export terminals which facilitate large-scale production and distribution. Investing in R&D enhances the sector’s strengths even more. The US is one of the major purchasers of oil and gas on a global scale. This guarantees a consistent need for exploration, drilling, and production services in the country.

The regulatory conditions in numerous regions of North America, especially in the United States, have supported the expansion of the oil and gas sector. Policies that encourage energy self-sufficiency and tax systems which are beneficial for oilfield services firms inspire investment and growth opportunities. North America’s capacity to export oil and gas has significantly increased, especially as the U.S. shifts to being a net exporter of oil and liquefied natural gas (LNG). This ability to export strengthens the worldwide supply chain and enhances the area’s significance in the oilfield service industry.

If you require any specific information that is not covered currently, we will provide the same as a part of the customization >> https://introspectivemarketresearch.com/custom-research/17082

Comprehensive Offerings:

- Historical Market Size and Competitive Analysis (2017–2023): Detailed assessment of market size and competitive landscape over the past years.

- Historical Pricing Trends and Regional Price Curve (2017–2023): Analysis of historical pricing data and price trends across different regions.

- Market Size, Share, and Forecast by Segment (2024–2032): Projections and detailed insights into market size, share, and future growth by segment.

- Market Dynamics: In-depth analysis of growth drivers, restraints, opportunities, and key trends, with a focus on regional variations.

- Market Trend Analysis: Evaluation of emerging trends that are shaping the market landscape.

- Import and Export Analysis: Examination of trade patterns and their impact on market dynamics.

- Market Segmentation: Comprehensive analysis of market segments and sub-segments, with a regional breakdown.

- Competitive Landscape: Strategic profiles of key players across regions, including competitive benchmarking.

- PESTLE Analysis: Evaluation of the market through Political, Economic, Social, Technological, Legal, and Environmental factors.

- PORTER’s Five Forces Analysis: Assessment of competitive forces influencing the market.

- Industry Value Chain Analysis: Examination of the value chain to identify key stages and contributors.

- Legal and Regulatory Environment by Region: Analysis of the legal landscape and its implications for business operations.

- Strategic Opportunities and SWOT Analysis: Identification of lucrative business opportunities, coupled with a SWOT analysis.

- Conclusion and Strategic Recommendations: Final insights and actionable recommendations for stakeholders.

Related Report Links:

Public Cloud Platform as a Service (PaaS) Market: Public Cloud Platform as a Service (PaaS) Market Size Was Valued at USD 96.15 Billion in 2023, and is Projected to Reach USD 482.51 Billion by 2032, Growing at a CAGR of 19.63% From 2024-2032.

Process Safety Services Market: Process Safety Services Market Size Was Valued at USD 4.01 Billion in 2023 and is Projected to Reach USD 6.22 Billion by 2032, Growing at a CAGR of 4.99% From 2024-2032

Telecom Services Market: Telecom Services Market Size is Valued at USD 1917.55 Billion in 2023, and is Projected to Reach USD 3295.10 Billion by 2032, Growing at a CAGR of 6.20% From 2024-2032.

Oilfield Chemicals Market: Oilfield Chemicals Market Size Was Valued at USD 28.32 billion in 2023 and is Projected to Reach USD 38.6 Billion by 2032, Growing at a CAGR of 3.5% From 2024-2032.

Mobile Satellite Services Market: Mobile Satellite Services Market Size Was Valued at USD 6.0 Billion in 2023, and is Projected to Reach USD 10.5 Billion by 2032, Growing at a CAGR of 6.49% From 2024-2032.

Business Software And Services Market: Business Software And Services Market Size Was Valued at USD 648.62 Billion in 2023, and is Projected to Reach USD 1,933.02 Billion by 2032, Growing at a CAGR of 12.90% From 2024-2032.

Cloud Telephony Service Market: Cloud Telephony Service Market Size is Valued at USD 25.01 Billion in 2023, and is Projected to Reach USD 52.42 Billion by 2032, Growing at a CAGR of 9.70% From 2024-2032.

Oilfield Equipment Market: Oilfield Equipment Market Size is Valued at USD 132.23 Billion in 2023 and is Projected to Reach USD 166.21 Billion by 2032, Growing at a CAGR of 2.90% From 2024-2032.

IoT Managed Services Market: IoT Managed Services Market Size Was Valued at USD 81.76 Billion in 2023, and is Projected to Reach USD 940.48 Billion by 2032, Growing at a CAGR of 31.18% From 2024-2032.

Full-Service Carrier Market: Full-Service Carrier Market Size Was Valued at USD 3.56 Billion in 2023, and is Projected to Reach USD 5.87 Billion by 2032, Growing at a CAGR of 5.7% From 2024-2032.

About Us:

Introspective Market Research is a top global market research company, that uses big data and advanced analytics to offer strategic insights and consulting services that help clients predict future market trends. At IMR, our team of experts helps businesses understand past and present market trends to provide insight into future developments.

Having a solid network with top companies in the industry gives us the ability to gather important market information, which helps us create accurate research data tables and achieve a high level of precision in market predictions. Led by CEO Mrs. Swati Kalagate, who promotes a culture of excellence, we are dedicated to providing top-notch data and assisting our clients in reaching their business objectives

The information in our reports comes from direct interviews with important executives from leading companies in the appropriate industries. Our thorough process for collecting secondary data includes extensive research both online and offline, as well as detailed conversations with industry professionals and analysts.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: [email protected]

LinkedIn| Twitter| Facebook | Instagram

Ours Websites : https://introspectivemarketresearch.com | https://imrknowledgecluster.com/knowledge-cluster | https://imrtechsolutions.com | https://imrnewswire.com/ | https://marketnresearch.de |

Wall St Business News, Latest and Up-to-date Business Stories from Newsmakers of Tomorrow