Austin, July 05, 2025 (GLOBE NEWSWIRE) —

When you’re in urgent need of cash, financial institutions are often sought for assistance. However, obtaining an instant payday loan has always proven to be challenging. If you, like many other Americans, face this problem, we have the solution. Honest Loans offer no denial payday loans from direct lenders, even with lenient requirements.

With these brokers, issues such as bad credit, little to no credit history, unemployment, or low-income levels are not obstacles. They can connect you with the top direct lenders of payday loans.

Getting a no denial payday loan from a direct lender is now easier with our list of the best brokers in the market. Here is where you can apply and get your loan today:

No Denial Payday Loan Companies

Obtaining a no denial payday loan from the brokers mentioned above is just a click away. Click on your preferred lender and follow the steps to have your loan approved.

Keep reading to make an informed decision that will help you meet your financial needs.

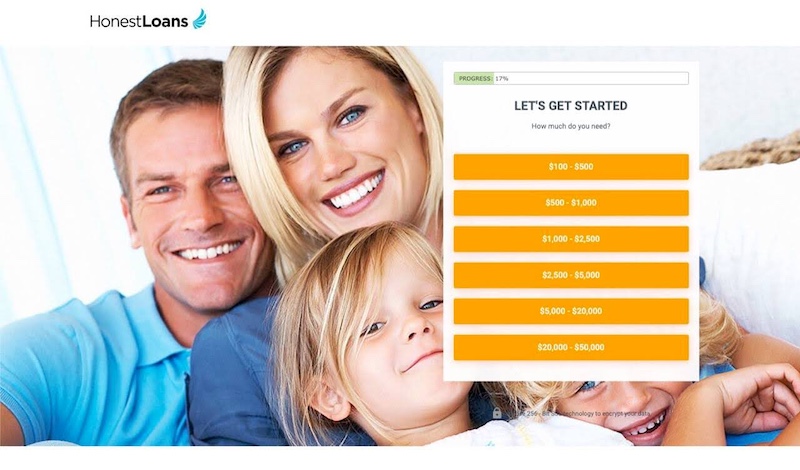

- Honest Loans: Cheapest no denial payday loans

If you are a borrower looking for the best no denial payday loan from a direct lender who has the cheapest loans, then Honest Loans is your best pick. With lending amounts that start from $100 to $50,000, you don’t have to worry about liquidity anymore.

Honest Loans extends these no denial payday loans to you instantly without any delays, regardless of your credit history or employment background. Their fast approval process takes a maximum of one day to deposit the requested amount in your account. As a plus, you are guaranteed better rates once you become their regular client.

Pros of Honest Loans

- Cheap no denial payday loans.

- Direct access to lenders.

- Loyalty awards.

- Fast loan approvals.

- Low-interest rates.

- Allow early loan repayment without penalties.

- High approval rate.

- Easy and convenient online application.

Honest Loans is a good option if you urgently need large amounts of payday loans at lower prices from direct lenders without denial.

No Denial Payday Loans From Direct Lenders Explained

No denial payday loans from direct lenders are unsecured short-term loans where direct lenders are willing to provide funds through brokers like the ones we’ve mentioned previously. The term “no denial” implies that once you meet all the eligibility requirements and standards set by the broker, which are based on their pool of direct lenders, you will receive genuine loan offers.

The main advantage of no denial payday loans from direct lenders is that they allow individuals facing financial challenges to secure funds in times of need. By bypassing the extensive credit checks and strict eligibility criteria often imposed by traditional lenders, these loans offer a higher chance of approval for those with less-than-ideal credit profiles.

However, it’s important to note that while no denial payday loans have more lenient approval criteria, they often have higher interest rates and fees than traditional loans.

To sum up, our recommended payday loans from direct lenders have a no denial policy, which means they provide an opportunity to obtain the funds you require, regardless of a poor credit score, low income, or current unemployment. These brokers collaborate with direct lenders who boast a high approval rate within the payday loan industry.

Eligibility Criteria for No Denial Payday Loans

Having a clear understanding of what is required of you as you apply for a no denial payday loan from direct lenders is crucial to increasing your chances of getting approved. Below are the factors considered:

- Minimum age: 18 years old or above.

- Citizenship status: US citizen or permanent resident.

- Contact information: You must have a valid phone number and email address

- Bank account: You must possess an active bank account.

- Income verification: You need to have a verifiable and consistent source of income to demonstrate your ability to repay the loan.

- Debt-to-income ratio (DTI): Your debt-to-income ratio should be within an acceptable range.

No Denial Payday Loans vs Conventional Loans

- Approval rate – Unlike conventional loans, no denial payday loans have higher approval rates. This is because they are designed to accommodate individuals with poor credit scores, no credit history, low income, or unemployment.

- Credit check – No denial payday loans often do not involve the performance of hard credit checks, or if they do, it is usually soft so that it doesn’t hurt the borrower’s request. This makes them more accessible to individuals with less-than-perfect credit histories. Conventional loans, on the other hand, require a thorough credit check.

- Loan amount and term – As no denial payday loans are intended to cater to immediate funds to meet short-term expenses, they have a relatively smaller amount coupled with shorter repayment terms. On the other hand, conventional loans offer larger loan amounts and longer repayment terms to cater to various purposes that are more capital intensive.

- Interest rates and fees – No denial payday loans often come with relatively higher interest rates and fees compared to conventional loans. The higher interest rates and fees are resultant of the short-term nature and the higher risk associated with them.

- Collateral requirement – As no denial payday loans are unsecured, they do not necessitate the need for collateral for one to be approved. In contrast, conventional loans, especially the ones that involve large amounts of funds, like mortgages or auto loans, often require collateral to secure the loan.

- Application process – No denial payday loans have a fast and simple application process, all of which is conducted online at your convenience. Conventional loans on the other hand require numerous and extensive documentation, most of which involves a lot of paperwork and queuing.

- Relationship with the lender – With no denial payday loans, borrowers are in a position to interact directly with the lender and the broker who connects them to the lender. This direct interaction facilitates a more personalized experience and enables borrowers to address any concerns and negotiate the terms of the loan. On the flip side, conventional loans involve dealing with loan officers and customer service representatives from respective financial institutions.

- Consumer protectionlaws – Conventional loans are subject to various regulations and consumer protection laws depending on the jurisdiction. These regulations aim to ensure fair lending practices, disclosure of terms, and borrower rights. In comparison, no denial payday loans have fewer regulatory protections. The duty to understand the rights and obligations of the loans, therefore wholly rests on the borrower.

Advantages of No Denial Payday Loans

- Ideal for emergencies – No denial payday loans are well-suited for addressing emergency financial needs. This is owed to the fact that they have a streamlined application process and fast approval processes that allow borrowers to obtain the money they need promptly, helping them navigate urgent situations.

- Presence of customized loans – No denial payday loans offer loan customization options that allow borrowers to request loan amounts that specifically meet their immediate needs. This flexibility enables individuals to borrow only what is necessary, avoiding the burden of excessive debt. Additionally, borrowers can select repayment terms that align with their financial capabilities, ensuring a more manageable loan experience.

- Good for credit-building – No denial payday loans serve as an opportunity for individuals to build and improve their credit scores. Timely and responsible repayment of payday loans contributes positively to a borrower’s credit history, potentially improving their creditworthiness over time. This is particularly beneficial for individuals with limited or poor credit histories, as it offers a chance to demonstrate creditworthiness and establish a positive record.

Disadvantages of No Denial Payday Loans

- Risk of debt cycle – If borrowers are unable to repay the loan in full by the due date, they may be tempted to roll over or renew the loan, incurring additional fees and interest. This can lead to a cycle of borrowing and accumulating more debt, making it challenging to break free from the loan cycle.

- Potential for predatory lending – Some unscrupulous lenders may engage in predatory practices, taking advantage of vulnerable borrowers.

Conclusion

In conclusion, no denial payday loans provide a much-needed lifeline during urgent financial situations when traditional lending options may not be accessible. These loans offer quick access to funds, minimal eligibility requirements, and the potential for credit building. However, it is crucial to approach these loans with caution and fully understand the associated costs, short repayment terms, and potential risks.

Responsible borrowing, careful evaluation of alternatives, and diligent repayment are essential to avoid falling into a cycle of debt. By weighing the pros and cons, individuals can make informed decisions and utilize no denial payday loans as a temporary solution while striving toward long-term financial stability.

Frequently Asked Questions

How do no denial payday loans work?

When you apply for a no denial payday loan, your application is submitted through a broker who shares it with a pool of direct lenders. If you meet the minimum eligibility requirements, you will receive a loan offer. Once you accept the offer, the funds are typically deposited into your bank account on the same day or within a short period.

Are no denial payday loans available in all states?

Payday loan regulations vary by state, and some states may have restrictions or prohibitions on payday lending. It’s essential to check the legality and regulations regarding payday loans in your state before applying. Additionally, lenders may have their eligibility criteria and may not operate in all states.

Are there any restrictions on how I can use the funds from a no denial payday loan?

Once approved and the funds are disbursed to your bank account, you can typically use the loan amount for any legitimate purpose. Whether it’s covering emergency expenses, paying bills, or addressing other financial needs, the usage of the funds is generally flexible and at your discretion.

- Company: Honest Loans

- Phone: 888-718-9134

- Email: [email protected]

Disclaimer and Affiliate Disclosure

The information presented in this article is provided for general informational and educational purposes only and does not constitute financial, legal, or professional advice. The content is based on independent research, publicly available data, and third-party sources believed to be reliable at the time of publication. However, accuracy cannot be guaranteed, and there may be inadvertent errors, outdated information, or inaccuracies in the material provided. Readers are strongly encouraged to independently verify all details before taking any financial action.

Neither this article nor any of its associated content should be interpreted as an offer, recommendation, or endorsement of any specific loan product, financial institution, or lending service. Any decision to engage with a lender or financial broker should be made at the reader’s own discretion and risk, after conducting thorough due diligence and consulting with a licensed professional, if necessary.

This publication may include affiliate links, meaning a commission may be earned from qualifying actions or purchases made through such links at no additional cost to the reader. These affiliate relationships do not influence the content, which remains editorially independent.

The parties responsible for publishing, syndicating, or distributing this content disclaim all liability for any direct or indirect loss, damages, or consequences resulting from the use of any information provided herein. This includes, but is not limited to, financial loss, reputational harm, or legal exposure resulting from decisions based on or related to this content.

Loan terms, conditions, and availability may vary by state and lender. All lending decisions are solely at the discretion of the respective direct lenders and are subject to applicable laws and regulations. Access to payday loans or similar financial services is not guaranteed and may be restricted in certain jurisdictions.

Syndication partners, media outlets, and third-party distributors are held harmless and are not responsible for the content’s accuracy, completeness, or any legal claims resulting from its use or interpretation. By continuing to engage with this article, the reader acknowledges and agrees to these terms.

Wall St Business News, Latest and Up-to-date Business Stories from Newsmakers of Tomorrow