Austin, TX, USA, July 01, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Life Reinsurance Market Size, Trends and Insights By Type (Facultative Reinsurance, Treaty Reinsurance), By Offering (Mortality Solutions, Morbidity Solutions, Longevity Solutions, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033” in its research database.

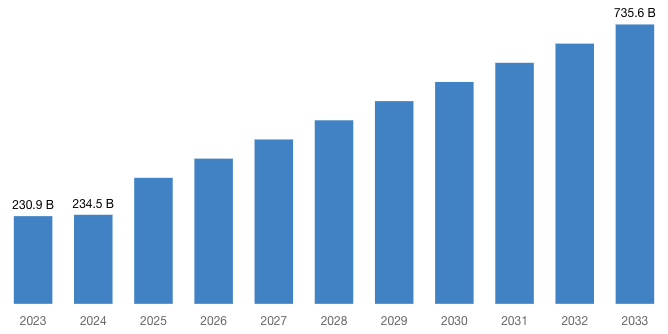

“According to the latest research study, the demand of global Life Reinsurance Market size & share was valued at approximately USD 230.9 Billion in 2023 and is expected to reach USD 234.5 Billion in 2024 and is expected to reach a value of around USD 735.6 Billion by 2033, at a compound annual growth rate (CAGR) of about 12.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Life Reinsurance Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=48153

Life Reinsurance Market: Overview

Life reinsurance allows main insurance companies to manage risk exposure better by sending some of the financial risk connected to their life insurance policies to reinsurers. By transferring risk, primary insurers can lower their exposure to significant, unanticipated losses, increase their solvency ratios, and underwrite more policies.

The growing emphasis on mortality trends and longevity risk is one significant worldwide trend in the life reinsurance business. The aging of populations worldwide has increased the need for longevity risk solutions, which reinsurers must meet.

Longevity risk is the unpredictability of an individual’s life expectancy and the resulting financial consequences. In an innovative move, reinsurers are helping primary insurers better manage their exposure to longevity risk by providing longevity risk transfer options including reinsurance agreements and longevity swaps.

Furthermore, advances in predictive modeling and data analytics are helping reinsurers better understand mortality patterns and adjust risk transfer programs accordingly. In general, the life reinsurance sector is becoming more specialized in controlling risk due to changing demographics and technological advancements.

Request a Customized Copy of the Life Reinsurance Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=48153

By type, the treaty reinsurance segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. The growing need for specialized solutions catered to particular risk profiles and coverage requirements of primary insurers, spurred by data analytics, technology breakthroughs, and changing regulatory frameworks, is a noteworthy development in treaty reinsurance.

By offering, the mortality solution segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. To estimate mortality risks and allow insurers to more precisely customize plans and pricing, mortality solutions are progressively using artificial intelligence and sophisticated analytics. Furthermore, using digital health data and streamlining underwriting procedures to increase productivity and control risk are becoming more and more important.

An important development in the life reinsurance market in the Asia-Pacific area is the growing use of digitalization and technology-driven solutions, which enable more effective underwriting procedures, data analytics, and product innovation to satisfy changing customer demands and legal obligations.

Berkshire Hathaway Life is a risk management firm that offers insurance and reinsurance solutions for the pension and healthcare industries. Berkshire Hathaway offers insurance and reinsurance products covering property and casualty risks, as well as life and health risks.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 234.5 Billion |

| Projected Market Size in 2033 | USD 735.6 Billion |

| Market Size in 2023 | USD 230.9 Billion |

| CAGR Growth Rate | 12.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Type, Offering and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Life Reinsurance report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Life Reinsurance report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Life Reinsurance Market Report @ https://www.custommarketinsights.com/report/life-reinsurance-market/

CMI has comprehensively analyzed the Global Life Reinsurance market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict the in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Life Reinsurance industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Request a Customized Copy of the Life Reinsurance Market Report @ https://www.custommarketinsights.com/report/life-reinsurance-market/

Key questions answered in this report:

- What is the size of the Life Reinsurance market and what is its expected growth rate?

- What are the primary driving factors that push the Life Reinsurance market forward?

- What are the Life Reinsurance Industry’s top companies?

- What are the different categories that the Life Reinsurance Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Life Reinsurance market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Life Reinsurance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/life-reinsurance-market/

Life Reinsurance Market: Regional Analysis

By region, Life Reinsurance market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. The Asia-Pacific dominated the global Life Reinsurance market in 2023 with a market share of 44.1% and is expected to keep its dominance during the forecast period 2024-2033.

In the Asia-Pacific region, families and individuals search to safeguard their financial futures. As a result, there is an increasing need for life insurance policies, which in turn fuels the need for reinsurance to reduce risk for primary insurers.

In addition, the adoption of reinsurance as a way to improve insurers’ solvency and risk management procedures is encouraged by the changing regulatory environment in many Asia-Pacific nations. Regulatory changes frequently force insurers to have adequate capital reserves, which forces them to assign some of their risks to reinsurers.

Furthermore, the region’s susceptibility to aging populations and other demographic changes, as well as natural disasters, emphasizes the significance of the efficient risk transfer mechanisms offered by reinsurance. To help primary insurers manage and diversify their exposure to such risks, reinsurers are essential.

In addition, digitization and technology developments are reshaping the Asia-Pacific life reinsurance industry by enabling more effective underwriting procedures, data analytics, and product innovation. Increased cooperation between insurers and reinsurers is encouraged by this trend, which propels the creation of customized solutions to satisfy the changing demands of the local client base.

In general, the dynamic economic growth, regulatory changes, risk environment, and technology breakthroughs of the Asia-Pacific region all work together to drive the growth and development of the life reinsurance industry.

Request a Customized Copy of the Life Reinsurance Market Report @ https://www.custommarketinsights.com/report/life-reinsurance-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: [email protected]

Browse the full “Life Reinsurance Market Size, Trends and Insights By Type (Facultative Reinsurance, Treaty Reinsurance), By Offering (Mortality Solutions, Morbidity Solutions, Longevity Solutions, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033” Report at https://www.custommarketinsights.com/report/life-reinsurance-market/

List of the prominent players in the Life Reinsurance Market:

- Munich Re

- Swiss Re

- Hannover Re

- SCOR SE

- Reinsurance Group of America

- China Reinsurance Group Corporation

- Korean Reinsurance Company

- Berkshire Hathaway Reinsurance Group

- Transamerica Reinsurance

- PartnerRe

- Everest Re Group

- Generali Group

- Mapfre Re

- XL Catlin

- Pacific Life Re

- Mitsui Sumitomo Insurance Group

- Arch Reinsurance Ltd.

- Lloyd’s of London syndicates

- Munich Re America

- Manulife Financial Corporation

- Others

Click Here to Access a Free Sample Report of the Global Life Reinsurance Market @ https://www.custommarketinsights.com/report/life-reinsurance-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Candle Market: Candle Market Size, Trends and Insights By Type (Pillar Candles, Votive Candles, Container Candles, Taper Candles, Floating Candles, Tea Light Candles, Specialty Candles), By Material (Paraffin Wax, Soy Wax, Beeswax, Palm Wax, Gel Wax, Others), By Fragrance (Scented Candles, Unscented Candles), By Distribution Channel (Online, Offline), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Fashion Jewelry Market: Fashion Jewelry Market Size, Trends and Insights By Material Type (Metal, Gemstones, Artificial gemstones, Pearls, Others), By Product Type (Necklace, Chains, Earrings, Rings, Bracelets, Others), By Gender (Male, Female), By Sales Channel (Speciality Stores, Supermarket and Hypermarket, Online, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

B2B Meetings Market: B2B Meetings Market Size, Trends and Insights By Industry Verticals (Healthcare, Pharmaceuticals, Medical Devices, Healthcare IT, Technology, Software, Hardware, IT Services, Finance, Banking, Insurance, Investment, Manufacturing, Automotive, Aerospace, Consumer Goods, Retail, E-commerce, Brick-and-Mortar, Fashion and Apparel), By Meeting Types (Trade Shows, Conferences, Networking Events, Seminars, Webinars, Others), By Meeting Mode (Virtual Meetings, Hybrid Events, Traditional Face-to-Face Meetings), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

India Housing Finance Market: India Housing Finance Market Size, Trends and Insights By Source (Bank, Housing Finance Companies (HFC’s)), By Interest Rate (Fixed Rate, Floating Rate), By Tenure (Up to 5 Years, 6 – 10 Years, 11 – 24 Years, 25 – 30 Years), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Women Luxury Footwear Market: Women Luxury Footwear Market Size, Trends and Insights By Product (Sneakers, Loafers, Fashion Footwear, Formal Footwear, Others), By Age Group (Below 24 Years, 25 Years To 45 Years, 46 Years and Above), By Distribution Channel (Online, Offline), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Luxury Sunglasses Market: Luxury Sunglasses Market Size, Trends and Insights By Product (Polarized, Non-polarized), By Type (Aviator Sunglasses, Wayfarer Sunglasses, Round Sunglasses, Sport Sunglasses, Others), By Application (Fashion and Style, Sports and Performance, Driving and Automotive, Outdoor Activities, Others), By Gender (Male, Female), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Life Reinsurance Market is segmented as follows:

By Type

- Facultative Reinsurance

- Treaty Reinsurance

By Offering

- Mortality Solutions

- Morbidity Solutions

- Longevity Solutions

- Others

Click Here to Get a Free Sample Report of the Global Life Reinsurance Market @ https://www.custommarketinsights.com/report/life-reinsurance-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Life Reinsurance Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Life Reinsurance Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Life Reinsurance Market? What Was the Capacity, Production Value, Cost and PROFIT of the Life Reinsurance Market?

- What Is the Current Market Status of the Life Reinsurance Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Life Reinsurance Market by Considering Applications and Types?

- What Are Projections of the Global Life Reinsurance Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Life Reinsurance Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Life Reinsurance Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Life Reinsurance Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Life Reinsurance Industry?

Click Here to Access a Free Sample Report of the Global Life Reinsurance Market @ https://www.custommarketinsights.com/report/life-reinsurance-market/

Reasons to Purchase Life Reinsurance Market Report

- Life Reinsurance Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Life Reinsurance Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Life Reinsurance Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Life Reinsurance Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Life Reinsurance market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Life Reinsurance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/life-reinsurance-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Life Reinsurance market analysis.

- The competitive environment of current and potential participants in the Life Reinsurance market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Life Reinsurance market should find this report useful. The research will be useful to all market participants in the Life Reinsurance industry.

- Managers in the Life Reinsurance sector are interested in publishing up-to-date and projected data about the worldwide Life Reinsurance market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Life Reinsurance products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Life Reinsurance Market Report @ https://www.custommarketinsights.com/report/life-reinsurance-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: [email protected]

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Life Reinsurance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/life-reinsurance-market/

Wall St Business News, Latest and Up-to-date Business Stories from Newsmakers of Tomorrow