Austin, TX, USA, May 14, 2025 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Accident Insurance Market Size, Trends and Insights By Type of Accident Insurance (Personal Accident Insurance, Workplace Accident Insurance), By Policy Coverage (Accidental Death Coverage, Permanent Disability Coverage), By Customer Type (Individual Customers, Young Adults), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034” in its research database.

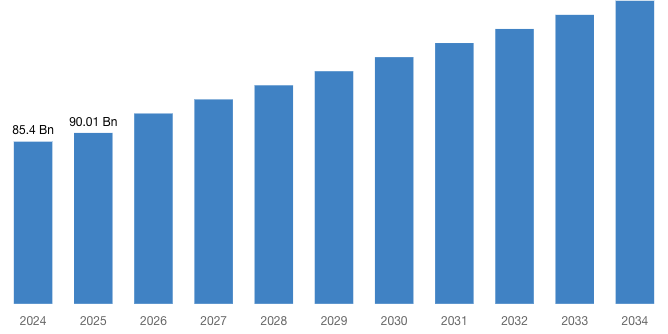

“According to the latest research study, the demand of the global Accident Insurance Market size & share was valued at approximately USD 85.40 Billion in 2024 and is expected to reach USD 90.01 Billion in 2025 and is expected to reach a value of around USD 159.60 Billion by 2034, at a compound annual growth rate (CAGR) of about 6.57% during the forecast period 2025 to 2034.”

Click Here to Access a Free Sample Report of the Global Accident Insurance Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=69736

Accident Insurance Market Overview

The global Accident Insurance Market is changing at a very rapid rate with a growing need for personalized, cost-effective, and digitally enabled insurance products. Industry giants such as China Life Insurance, PingAn, AXA, Sumitomo Life Insurance, and Aegon are spearheading the transformation with AI-enabled claims settlement, mobile app-based policy management, and personalized accident coverage policies.

Chinese insurers China Life and PingAn are leveraging big data analytics to measure risks and enhance underwriting accuracy. European players such as AXA and Aegon are leading with embedded insurance and expanding digital distribution through bancassurance and fintech partnerships. Japanese behemoth Sumitomo Life, in turn, is focusing on digital transformation to reach aging segments and introduce wellness-bundled accident coverage.

With global markets, public-private partnerships are also starting to find traction through regulatory direction and financial education campaigns, establishing accident insurance as a strong foundation of financial security.

Accident Insurance Market Growth Factors and Dynamics

Increasing Road Traffic Accidents: Increasing road traffic accidents globally have increased the need for accident insurance. As more and more individuals become aware of the cost incurred due to vehicular accidents, there is increased demand for insurance products offering coverage in case of medical costs, disability, and loss of income due to accidents. For instance, in April 2025, China Life Insurance posted a strong year-over-year 40% quarterly net profit of 28.8 billion yuan during Q1 2025, driven by exemplary investment yields and steady demand for savings-type insurance products.

Investment income surged dramatically to 25.2 billion yuan due to a tactical focus on high-dividend stocks and higher-yielding bonds, while experiencing minimal fair-value losses. Premium income increased by 5%, and new business value rose by 4.8%, both reflecting a broader industry trend of increasing demand for life insurance as consumers seek long-term savings solutions in a low interest rate environment.

Increasing Financial Protection Awareness: There is a growing world awareness of the need for financial protection from unexpected situations. This awareness encourages people and organizations to invest in accident insurance as a way to protect themselves from potential financial losses arising from accidents.

Request a Customized Copy of the Accident Insurance Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=69736

For example, in April 2025, Ping An’s 2024 Sustainability Report highlights robust financial and ESG performance, highlighting 30 years of education for public welfare and its “worry-free, time-saving, and money-saving” service. The firm posted 9.1% operating profit and 47.8% net profit growth, as its integrated comprehensive finance and health ecosystem served 242 million retail customers.

Expansion was led by tech innovation, with over 55,000 fintech and healthtech patents and AI processing 80% of customer queries. Ping An took the lead in green finance, saw a 57% increase in green insurance premiums, an 8% decrease in emissions, and provided funding for small and micro enterprises. Its business earned best-in-class ESG ratings and inclusion in leading performing sustainability indices.

The growth of the middle-class population worldwide, especially in emerging markets, has resulted in increased disposable income. A higher financial burden enables more individuals to afford and include accident insurance as a key component of their personal finance planning.

AXA announced in February 2025 a record year financially for 2024, in which net profit rose 11% to USD 8.94 billion, while revenues in total rose 8% to USD 124.9 billion. Expansion was fueled by robust performance in all segments, such as a 7% increase in property & casualty premiums, an 8% increase in life & health premiums (with a significant 18% increase in unit-linked products), and an 8% increase in asset management revenues.

Underlying earnings increased 7% to USD 9.1 billion, while asset management earnings increased 11%. Even as the Solvency II ratio declined to 216%, CEO Thomas Buberl credited the performance to the successful implementation of AXA’s “Unlock the Future” strategy, with a strong insurance strategy and solid balance sheet.

Report Scope

| Feature of the Report | Details |

| Market Size in 2025 | USD 90.01 Billion |

| Projected Market Size in 2034 | USD 159.60 Billion |

| Market Size in 2024 | USD 85.40 Billion |

| CAGR Growth Rate | 6.57% CAGR |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Key Segment | By Type of Accident Insurance, Policy Coverage, Customer Type and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Accident Insurance report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- The 2024 updated report includes an introduction, an overview, and an in-depth industry analysis.

- The package includes the COVID-19 Pandemic Outbreak Impact Analysis.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2025

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Accident Insurance report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Accident Insurance Market Report @ https://www.custommarketinsights.com/report/accident-insurance-market/

Accident Insurance Market SWOT Analysis

- Strengths: Increasing global awareness for personal security and money risk management strengthens the accident insurance market. Its capability of tailoring coverage across the different segments of customers—individuals, employees, and youth—raises its appeal. Addition of digital channels, faster claim settlement, and hospital and employer arrangements provide added support to its market position.

- Weaknesses: One of the major weaknesses is the complexity of policy terms, which can confuse customers and lead to the underpenetration of benefits. Second, low insurance penetration and weak financial literacy in emerging markets limit its potential. The other weakness is the reliance of traditional insurers on legacy IT systems, which stifles innovation.

- Opportunities: There is a giant opportunity in emerging markets where accident insurance remains underdeveloped. Microinsurance for poor segments and digitally first policies tailored to younger, technology-savvy consumers present strong growth opportunities. Telemedicine and wearable devices for real-time health monitoring can also provide new value-added products.

- Threats: Regulatory overhauls, privacy concerns in data, and fraud constitute the highest threats to the accident insurance industry. Economic recession in certain regions of the world can also cap consumer spending on insurance. Stiffer competition from insurtech companies that have more agile and technology-based solutions can also unseat conventional players.

Request a Customized Copy of the Accident Insurance Market Report @ https://www.custommarketinsights.com/report/accident-insurance-market/

Key questions answered in this report:

- What is the size of the Accident Insurance market and what is its expected growth rate?

- What are the primary driving factors that push the Accident Insurance market forward?

- What are the Accident Insurance Industry’s top companies?

- What are the different categories that the Accident Insurance Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the sample report on the Accident Insurance market and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2025−2034

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Accident Insurance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/accident-insurance-market/

Accident Insurance Market Regional Perspective

The Accident Insurance Market can be divided across different regions such as North America, Europe, Asia-Pacific, and LAMEA. This is a cursory overview of each region:

- North America: In the U.S., Geico, which is part of Berkshire Hathaway, has advanced considerably toward embedding telematics technology for more closely associating insurance costs with customer risk profiles. That puts Geico ahead in making use of driver-installed units in monitoring and evaluating driving conduct to optimize the price strategy. For instance, the widespread impact of the Los Angeles fires in May 2025 precipitated a steep decline in AIG’s first-quarter 2025 profit, amounting to $0.525 billion in catastrophe losses, with direct fires accounting for $0.46 billion of these losses. This resulted in a year-over-year decline in underwriting profits of 59% to $0.243 billion. The blazes, which produced an estimated $40 billion of insured losses, were among the most expensive on record. Despite these challenges, AIG’s adjusted per-share earnings exceeded analyst expectations; however, persistent catastrophe threats and economic uncertainty pose significant hurdles for the insurance industry.

- Europe: European officials have taken steps to make Russian oil tankers carrying Russian crude carry sufficient accident insurance, a bid to close down Russia’s “dark fleet” of ageing ships circumventing sanctions. The coastal nations of Britain, Denmark, Sweden, Poland, Finland, and Estonia are already demanding insurance documents from ships navigating premier European waters. For example, the November 2024 denunciation of Russian exploitation by Russia of a “shadow fleet” of tanker vessels to evade EU sanctions in May 2024 at risk to the environment, economy, and security. The untraceable, uninsured ships, plying around European shores with AIS transmitters switched off, have the potential to create humongous oil spills, which will harm sea life, tourism, and public health. The remedy demands tougher EU sanctions, such as blacklisting shadow fleet ships, prohibiting ship-to-ship transfers, enforcing insurance and safety provisions, and enhanced international cooperation. It also calls for vessel ownership transparency and improved mechanisms to prevent sanctions evasions, citing the effect on EU sanctions and Ukraine aid.

- Asia-Pacific: BYD, a Chinese electric vehicle manufacturer, received regulatory approval in 2024 to sell motor liability insurance as part of a broader trend among automakers moving into the insurance sector to expand customer experience and market presence. For instance, in April 2024, In 2023, natural catastrophes in the Asia Pacific region caused an estimated USD 65 billion of economic losses, 48% less than the 21st-century average, but only 9% (about USD 6 billion) was covered, showing a massive protection gap. Flooding, especially in China, accounted for over 64% of the losses, while India’s droughts and other extreme weather events. Aon underscores the need for advanced climate modelling, advanced risk analysis, and more insurance coverage in order to increase resilience and protect communities against rising climate hazards.

- LAMEA: The LAMEA region is witnessing consistent growth in accident insurance, fueled by regulatory changes and innovation. In Brazil, the market increased in 2024 with the introduction of a modernized insurance contract law. Middle Eastern reinsurers relaxed conflict-related exclusions, boosting policy stability. Africa rolled out parametric insurance to cover climate risks. Ghana launched the POKUAA digital platform to facilitate insurance services. These advances indicate increasing modernization and accessibility in the region.

Request a Customized Copy of the Accident Insurance Market Report @ https://www.custommarketinsights.com/report/accident-insurance-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do you want data for inclusion in magazines, case studies, research papers, or media?

Email Directly Here with Detail Information: [email protected]

Browse the full “Accident Insurance Market Size, Trends and Insights By Type of Accident Insurance (Personal Accident Insurance, Workplace Accident Insurance), By Policy Coverage (Accidental Death Coverage, Permanent Disability Coverage), By Customer Type (Individual Customers, Young Adults), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034” Report at https://www.custommarketinsights.com/report/accident-insurance-market/

Here is a list of the prominent players in the Accident Insurance Market:

- China Life Insurance

- PingAn

- AXA

- Sumitomo Life Insurance

- Aegon

- Dai-ichi Mutual Life Insurance

- CPIC

- Aviva

- Munich Re Group

- Zurich Financial Services

- Nippon Life Insurance

- Gerber Life Insurance

- AIG

- Others

Click Here to Access a Free Sample Report of the Global Accident Insurance Market @ https://www.custommarketinsights.com/report/accident-insurance-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- We offer free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- The author has created a personalized market brief.

Browse More Related Reports:

Insurance Agency Portal Market: Insurance Agency Portal Market Size, Trends and Insights By Component (Software, Services), By Deployment Mode (On-Premises, Cloud), By Enterprise Size (Small and Medium Enterprises, Large Enterprises), By End-User (Insurance Companies, Brokers, Agents, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

Sustainable Supply Chain Finance Market: Sustainable Supply Chain Finance Market Size, Trends and Insights By Type of Financing (Invoice Financing, Purchase Order Financing, Inventory Financing, Warehouse Receipt Financing, Freight Financing, Asset-Backed Lending), By Industry Vertical (Manufacturing, Retail, Transportation, Healthcare, Technology, Energy, Agriculture), By Company Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Deployment Model (Cloud-based, On-premise), By Integration (Enterprise Resource Planning (ERP) Systems Integration, Supply Chain Management (SCM) Systems Integration, Transportation Management Systems (TMS) Integration), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034

Letter Of Credit Confirmation Market: Letter Of Credit Confirmation Market Size, Trends and Insights By Type (Issuing Bank Confirmation, Accredited Independent Confirmation, Confirming Bank Confirmation), By Application (Import, Export, Domestic Transactions), By Size of Letter (Small Letters of Credit, Medium Letters of Credit, Large Letters of Credit), By Tenor (Short-Term Letters of Credit, Medium-Term Letters of Credit, Long-Term Letters of Credit), By Confirmation Fee Structure (Fixed Fee, Percentage Fee, Tiered Pricing), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034

EMV Card Market: EMV Card Market Size, Trends and Insights By Card Type (Credit Cards, Debit Cards), By Application (Retail, Banking, Financial Services, and Insurance (BFSI), Hospitality, Healthcare, Transportation, Others (e.g., government, education)), By End-User (Consumers, Merchants), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

ATM Security Market: ATM Security Market Size, Trends and Insights By ATM Type (Onsite ATM, Offsite ATM), By Application (Fraud Detection, Security Management, Anti-Skimming, Others), By End User (Banks and Financial Institutions, Independent ATM Operators), By Solution (Deployment, Managed Service) and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

Doorstep Banking Market: Doorstep Banking Market Size, Trends and Insights By Component (Software, Services), By Deployment Model (On Premise, Cloud Based), By Services (Financial Services, Non-Financial Services, Others), By Application (Personal Banking, Business Banking), By End-User (Banks, Financial Institutions, Credit Unions, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

B2B Payments Market: B2B Payments Market Size, Trends and Insights By Payment Type (Domestic Payments, Cross-Border Payments), By Enterprise Size (Large Enterprises, Small and Medium Sized Enterprises), By Payment Mode (Traditional, Digital), By Industry Vertical (BFSI, Manufacturing, Metals & Mining, IT & Telecom, Energy & Utilities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

NBFC Market: NBFC Market Size, Trends and Insights By Type (NBFCs Accepting Public Deposit (NBFCs-D), NBFCs Not Accepting/Holding Public Deposit (NBFCs-ND)), By Service Type (Lending Services, Investment Services, Insurance Services, Leasing Services, Others), By Deployment Mode (Online Deployment, Branch-Based Deployment, Hybrid Deployment, Agent-Based Deployment, Others), By Application (Consumer, SME & Commercial Lending, Wealth Management, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The The following segments make up the accident insurance market:

By Type of Accident Insurance

- Personal Accident Insurance

- Workplace Accident Insurance

By Policy Coverage

- Accidental Death Coverage

- Permanent Disability Coverage

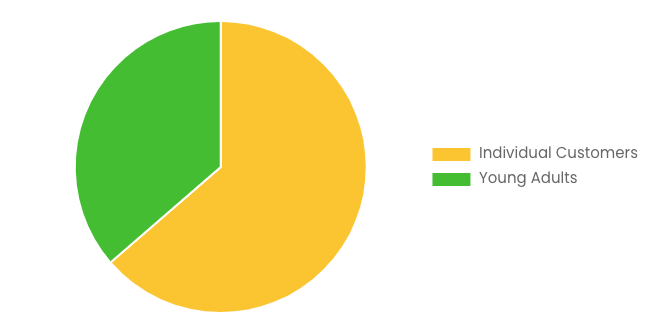

By Customer Type

- Individual Customers

- Young Adults

Click Here to Get a Free Sample Report of the Global Accident Insurance Market @ https://www.custommarketinsights.com/report/accident-insurance-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Accident Insurance Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Accident Insurance Market? What are the company profiles, product information, and contact details for these key players?

- What Was the Global Market Status of the Accident Insurance Market? What Was the Capacity, Production Value, Cost and PROFIT of the Accident Insurance Market?

- What Is the Current Market Status of the Accident Insurance Industry? What’s the market’s competition in this industry, both company-wise and country-wise? What’s the Market Analysis of the Accident Insurance Market by Considering Applications and Types?

- What Are Projections of the Global Accident Insurance Industry Considering Capacity, Production, and Production Value? What Will Be the estimate of Cost and Profit? What Will Be Market Share, Supply, and Consumption? What about imports and exports?

- What Is Accident Insurance Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On the Accident Insurance Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are the Market Dynamics of the Accident Insurance Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for the Accident Insurance Industry?

Click Here to Access a Free Sample Report of the Global Accident Insurance Market @ https://www.custommarketinsights.com/report/accident-insurance-market/

Reasons to Purchase Accident Insurance Market Report

- Accident Insurance Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Accident Insurance Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Accident Insurance Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- We provide extensive company profiles that include company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- The Accident Insurance Market includes an in-depth analysis from various perspectives using Porter’s five forces framework and offers insights into the market through the Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Accident Insurance market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established leaders drive market growth.

Buy this Premium Accident Insurance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/accident-insurance-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Accident Insurance market analysis.

- The competitive environment of current and potential participants in the Accident Insurance market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- We have provided actual market sizes and forecasts for each segment mentioned above.

Who should buy this report?

- Participants and stakeholders worldwide Accident Insurance market should find this report useful. The research will be useful to all market participants in the Accident Insurance industry.

- Managers in the Accident Insurance sector are interested in publishing up-to-date and projected data about the worldwide Accident Insurance market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Accident Insurance products’ market trends.

- Analysts, researchers, educators, strategy managers, and government organizations seek market insights to develop plans.

Request a Customized Copy of the Accident Insurance Market Report @ https://www.custommarketinsights.com/report/accident-insurance-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work toward achieving sustainable growth in their respective domains.

CMI offers a comprehensive solution from data collection to investment advice. Our company’s expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts utilize client insights to inform strategies for estimating future declines, forecasting opportunities for growth, and conducting consumer surveys.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 737-734-2707

India: +91 20 46022736

Email: [email protected]

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://businessresearchindustry.com

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Accident Insurance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/accident-insurance-market/

Wall St Business News, Latest and Up-to-date Business Stories from Newsmakers of Tomorrow