NEW YORK CITY, April 10, 2025 (GLOBE NEWSWIRE) — As businesses continue to navigate evolving payroll and human resources (HR) challenges, technology-driven solutions are becoming essential for efficiency, compliance, and workforce management. In recognition of its robust features, reliability, and seamless integration capabilities, QuickBooks Payroll has been awarded the title of Top Payroll Software for Small to Mid-Sized Businesses by Better Business Advice in its latest annual review of HR and payroll solutions.

Best HR & Payroll Software:

- QuickBooks Payroll – seamlessly integrates payroll processing with essential HR functions and support, making it an invaluable tool for small to mid-sized businesses aiming to streamline operations, ensure compliance, and foster employee satisfaction.

The evaluation, conducted by industry experts and analysts, assessed multiple factors, including automation capabilities, tax compliance support, HR functionality, and user experience. QuickBooks Payroll stood out for its ability to simplify payroll processing while also offering HR tools that help businesses manage employee benefits, tax obligations, and regulatory compliance with minimal administrative burden.

Growing Demand for Integrated HR & Payroll Solutions

With businesses facing increasing compliance regulations and workforce management complexities, streamlined payroll and HR software has become a necessity rather than a luxury. Many small to mid-sized companies are seeking solutions that not only automate payroll but also provide HR support, benefits management, and real-time reporting.

The latest market insights indicate a shift towards cloud-based payroll platforms that integrate seamlessly with accounting software and HR systems. QuickBooks Payroll has positioned itself as a leading choice in this category, offering automated tax calculations, same-day direct deposits, and built-in compliance support.

Key Features That Set QuickBooks Payroll Apart

QuickBooks Payroll’s recognition as the top payroll software for small to mid-sized businesses is attributed to its well-rounded features and intuitive design. Some of the standout functionalities include:

- Automated Payroll Processing – Payroll calculations, tax deductions, and direct deposits are handled automatically, reducing the risk of errors and late payments.

- Tax Compliance and Filing – The software ensures federal, state, and local payroll taxes are calculated and filed accurately. The Tax Penalty Protection feature also provides up to $25,000 coverage for tax-related penalties in eligible plans.

- Same-Day Direct Deposit – Businesses can process payroll and issue payments to employees on the same day, improving cash flow management and employee satisfaction.

- HR Support and Compliance Tools – Employers gain access to resources for labor law compliance, employee handbooks, and HR best practices. Higher-tier plans offer personalized HR advisory services.

- Time Tracking Integration – With built-in QuickBooks Time tracking, employees’ working hours sync directly into the payroll system, eliminating manual data entry.

- Employee Benefits Administration – The platform facilitates health insurance, 401(k) retirement plans, and workers’ compensation insurance, streamlining benefits management.

Flexible Plans and Pricing for Businesses of All Sizes

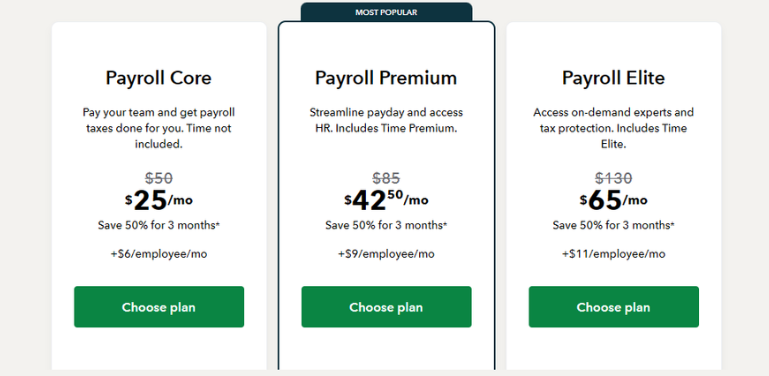

QuickBooks Payroll offers multiple pricing tiers designed to accommodate businesses at different growth stages. The three available plans provide varying levels of payroll automation, tax handling, and HR support:

- Core Plan – Includes full-service payroll, automated tax calculations and filings, and next-day direct deposit. Designed for businesses that need essential payroll features with reliable automation.

- Premium Plan – Expands on the Core plan by offering same-day direct deposit, time tracking integration, and access to the HR Support Center. Ideal for companies looking to manage payroll and basic HR needs on one platform.

- Elite Plan – The most comprehensive option, including Tax Penalty Protection, a dedicated HR advisor, and priority customer support. Best suited for businesses that require advanced compliance support and expert HR guidance.

The tiered pricing structure enables businesses to select a plan that aligns with their specific payroll and HR management needs while maintaining cost-effectiveness.

The Role of Payroll Software in Business Growth

Accurate and efficient payroll processing is crucial for businesses looking to scale operations while maintaining financial stability and compliance. Errors in payroll tax calculations or missed deadlines can lead to costly penalties and legal issues. Additionally, employee satisfaction is closely tied to reliable and timely payroll management.

By automating essential payroll and HR functions, software like QuickBooks Payroll enables business owners to focus on core operations, workforce engagement, and strategic growth. The shift towards digital payroll platforms reflects a broader industry trend where companies prioritize automation, compliance, and employee-centric HR solutions.

Industry Recognition and Market Outlook

Better Business Advice’s annual rankings evaluate HR and payroll solutions based on industry needs, user feedback, and software innovation. QuickBooks Payroll has consistently ranked among the leading platforms due to its user-friendly experience and comprehensive set of tools tailored to small and mid-sized businesses.

According to market analysts, payroll software adoption rates continue to rise as businesses embrace cloud-based financial management solutions. The integration of AI-driven automation, real-time tax calculations, and compliance tracking further enhances the value of these platforms.

The recognition from Better Business Advice reaffirms QuickBooks Payroll’s role in helping businesses navigate the complexities of payroll processing while maintaining compliance and efficiency.

For a full breakdown of the evaluation and insights into how QuickBooks Payroll compares across different business needs, the complete review can be read at Better Business Advice.

About Better Business Advice: Better Business Advice is a business advice website dedicated to helping businesses succeed. As an affiliate, Better Business Advice may earn commissions from services mentioned in the links provided. The information provided by Better Business Advice does not, and is not intended to, constitute legal advice; instead, all information, content, and materials are for general informational purposes only.

Wall St Business News, Latest and Up-to-date Business Stories from Newsmakers of Tomorrow