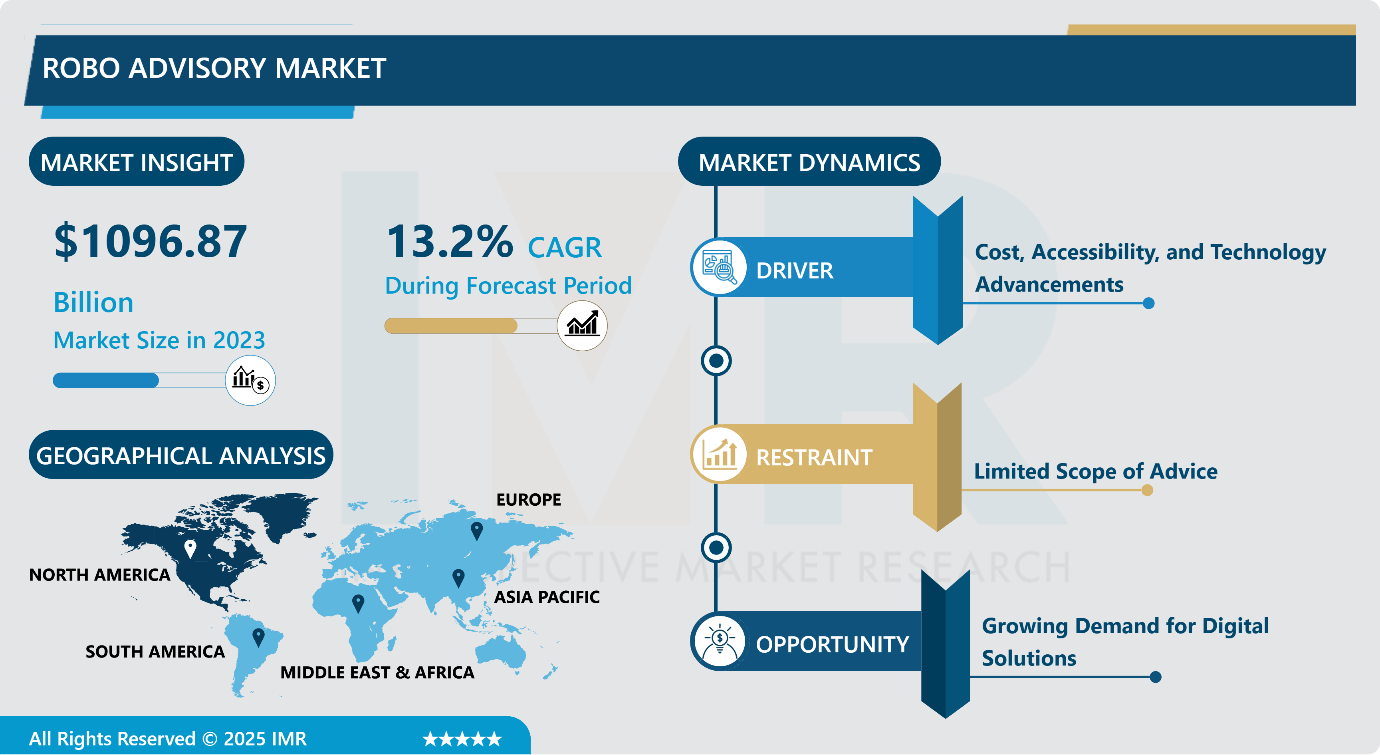

United States, San Francisco, Feb. 13, 2025 (GLOBE NEWSWIRE) — Introspective Market Research is pleased to announce the publication of its latest report, Robo Advisory Market. This in-depth analysis shows that the Global Robo Advisory Market, valued at USD 1096.87 Billion in 2023, is set for substantial growth and is projected to reach USD 3347.90 Billion by 2032. This anticipated expansion reflects a strong CAGR of 13.2% from 2024 to 2032.

Robo-advisors are online financial services that utilize AI-based algorithms to deliver automated investment management. They provide an affordable, passive method for investing, making them perfect for novices and individuals seeking to minimize expenses. Robo-advisors manage portfolio rebalancing, assess risk, and select investments with constant accessibility and complete transparency. They assist investors in handling risk according to their financial objectives and risk appetite. Although they provide impartial, data-driven recommendations, they might not be ideal for individuals seeking customized financial support. Key competitors in the robo-advisory sector are Betterment, Wealthfront, Vanguard Digital Advisor, and Schwab Intelligent Portfolios.

Download Sample 250 Pages Of Robo Advisory Market Report@ https://introspectivemarketresearch.com/request/16170

Key Industry Insights –

Driver: Cost, Accessibility, and Technology Advancements:

The robo-advisory market is driven by several key factors, including cost efficiency, accessibility, and technological advancements. Unlike traditional financial advisors, robo-advisors offer low-cost investment management with minimal fees, making them attractive to a broader audience. Their integration with digital platforms allows users to access automated financial planning anytime, enhancing convenience. AI-powered algorithms provide personalized investment strategies based on risk tolerance, financial goals, and market trends. Additionally, low entry barriers enable small investors to participate, further expanding the market. The growing demand for seamless, data-driven, and automated financial solutions continues to propel the adoption of robo-advisory services globally.

Restraints:

Limited Scope of Advice:

The robo-advisory market faces several restraints despite its growing popularity. Limited scope of advice remains a major challenge, as most robo-advisors primarily focus on basic investment strategies like asset allocation and portfolio rebalancing. They often lack capabilities for complex financial planning, including estate management, tax optimization, and tailored retirement strategies. Additionally, regulatory challenges, data security concerns, and the need for human financial expertise further hinder adoption. Many investors, especially high-net-worth individuals, prefer hybrid models that combine automation with human advisors.

Opportunity:

Growing Demand for Digital Solutions:

The robo-advisory sector offers a large opportunity as digital uptake in financial services speeds up. As the demand for affordable, automated investment options rises, robo-advisors provide tailored portfolio management while requiring little human involvement. The emergence of AI, big data, and machine learning improves their capacity to deliver real-time insights and manage risks. Younger investors, particularly millennials and Gen Z, favor digital-first financial options, fueling market growth. Moreover, the rising awareness of financial planning, along with reduced fees relative to conventional advisors, makes robo-advisory services appealing.

“Research made simple and affordable – Trusted Research Tailored just for you – IMR Knowledge Cluster”

https://www.imrknowledgecluster.com/

Challenge:

Competition and Profitability:

The robo-advisory sector experiences significant rivalry due to the influx of traditional financial entities and fintech newcomers. Companies need to distinguish their products to draw in and keep customers, which frequently results in reduced fees that compress profit margins. Elevated customer acquisition expenses additionally hinder profitability, since building trust in automated financial guidance requires time. Moreover, adhering to regulations introduces challenges and costs, especially with changing financial legislation. Maintaining technology and fostering ongoing innovation demand considerable investment, underscoring the importance of scalability.

Key Players to Watch:

- Betterment LLC (USA)

- Charles Schwab Corporation (USA)

- FutureAdvisor (USA)

- Hedgeable Inc (USA)

- Nutmeg (UK)

- Personal Capital (USA)

- Scalable Capital GmbH (Germany)

- SigFig Wealth Management (USA)

- StashAway (Singapore)

- Vanguard Personal Advisor (USA)

- Wealthfront Inc. (USA)

- WiseBanyan (USA)

- Other Active Players

Recent Development

In January 2025, Futu Holdings Limited, a leader in digital brokerage and wealth management, launched ETF-based intelligent robo-advisory services in collaboration with BlackRock. Introduced in Hong Kong and Singapore in September 2024, this service aimed to optimize investment solutions for clients. Partnering with BlackRock, Futu provided five flagship Target Allocation ETF Model Portfolios, leveraging iShares ETFs for diversified global exposure.

In December 2024, Mitsubishi UFJ Financial Group (MUFG) acquired Japanese robo-advisory firm WealthNavi for approximately JPY 99.7 billion ($664 million). Founded in 2015, WealthNavi provided an automated asset management platform, handling over JPY 1.3 trillion. Its services included portfolio management, tax optimization, and rebalancing. In February, MUFG secured a 15% stake before launching a tender offer at JPY 1,950 per share, an 84% premium, to make WealthNavi a wholly-owned subsidiary.

Want exclusive data insights on Robo Advisory Market Make an Inquiry now >> https://introspectivemarketresearch.com/inquiry/16170

Key Segments of Market Report –

By Business Model

- Pure Robo Advisors

- Hybrid Robo Advisors

By Application

- FinTech Robo Advisors

- Banks

- Traditional Wealth Managers

- Others

By Service Type

- Direct Plan-Based/Goal-Based

- Comprehensive Wealth Advisory

By End User

- Retail Investor

- High Net Worth Individuals

By Region:

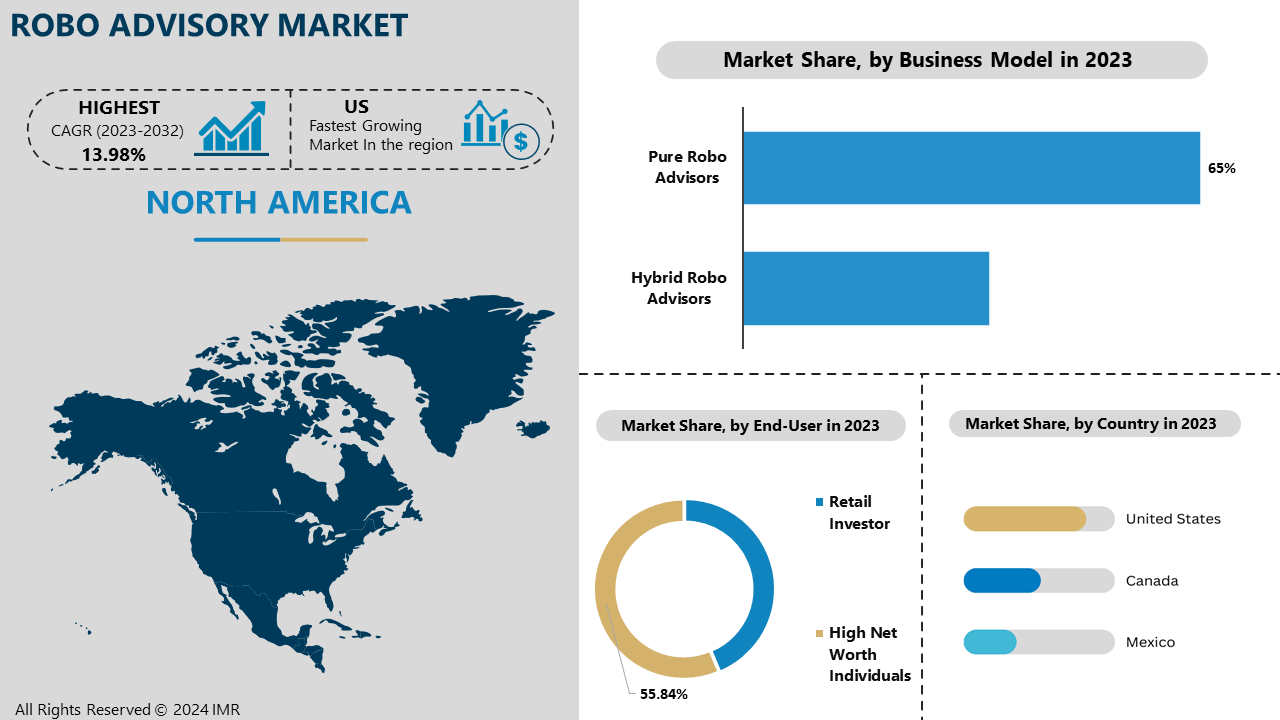

The North America region leads the worldwide robo-advisory industry, thanks to its high digital adoption, robust technological framework, and increasing confidence in automated financial services. The area hosts major contributors such as Betterment and Wealth front Corporation, who propel innovation and market growth. Consumers are increasingly choosing digital platforms for managing investments, taking advantage of AI-enhanced portfolio optimization and affordable advisory services. The elevated degree of financial understanding and regulatory assistance also promotes growth. With the increasing demand for smooth, automated investing, North America’s robust fintech ecosystem establishes it as a frontrunner in the robo-advisory arena, influencing the future of digital wealth management.

If you require any specific information that is not covered currently, we will provide the same as a part of the customization >> https://introspectivemarketresearch.com/custom-research/15446

Comprehensive Offerings:

Strategic Points Covered in Table of Content of Robo Advisory Market:

- Executive Summary: Into the market research report, the executive summary highlights the most critical market findings, including key trends and actionable insights, offering clients a snapshot of the report’s core takeaways.

- Market Landscape: This section is crafted to include a detailed analysis of Robo Advisory Market Dynamics, Growth Trends, And Regulatory Frameworks. Tools like PESTEL Analysis, Value Chain Analysis, and Investment Pockets are employed to present a thorough market outlook and future growth projections.

- Robo Advisory Market Competitive Analysis: The competitive analysis examines the Key Players, Their Positioning, Strengths, And Opportunities. By mapping competition, we provide actionable intelligence for clients to strategize effectively.

- Robo Advisory Market Segmentation Analysis: In segmentation, we break down the market into Key and Sub-Segments, focusing on their growth potential, demand patterns, and overall market contribution.

- Regional Analysis : Through in-depth global, regional, and country-level insights, we analyse key growth drivers and challenges specific to each geography.

- Robo Advisory Market Analyst Viewpoint and Conclusion: The concluding section consolidates the findings, offering strategic recommendations and emphasizing practical, client-centric strategies to navigate market complexities.

- Thematic Research Methodology: Leveraging primary and secondary research, we ensure data authenticity and reliability. Our reports follow the MORE Principle:

- Magnifying Insights: Delivering accurate and detailed research findings.

- Optimizing Strategies: Customizing strategies for client needs.

- Refining Solutions: Continuously enhancing research processes.

- Elevating Client Impact: Creating measurable value for client success.

About Us:

Introspective Market Research (IMR) is an international market research and consulting company that focuses on leveraging big data and sophisticated analytics to deliver in-depth market insights. Our team of specialists assists clients in understanding upcoming market trends by examining historical and current data, providing precise predictions, and suggesting practical strategies. We concentrate on demand evaluation, competitive comparison, and macro-economic analysis to provide comprehensive industry insights. IMR’s client-focused strategy guarantees individualized services, offering custom research and subscription reports specifically designed to meet each client’s requirements. With robust work principles, a devoted support team, and a focus on providing valuable, data-informed solutions, we assist our clients in confidently reaching their business objectives.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: [email protected]

Wall St Business News, Latest and Up-to-date Business Stories from Newsmakers of Tomorrow